Towards the end of your tax return papers, you state to the Canadian Revenue Agency or the CRA that the information you’re presenting them is true to your knowledge, and the CRA takes that seriously. Why would they bother with such a warning? It’s because it’s a serious offense to insert false entries in your tax return. But, not all irregularities with people’s tax returns are deliberate falsifications. People also tend to make genuine mistakes while preparing their tax returns. Let us unravel these common mistakes for your benefit.

Image source: https://pixabay.com/

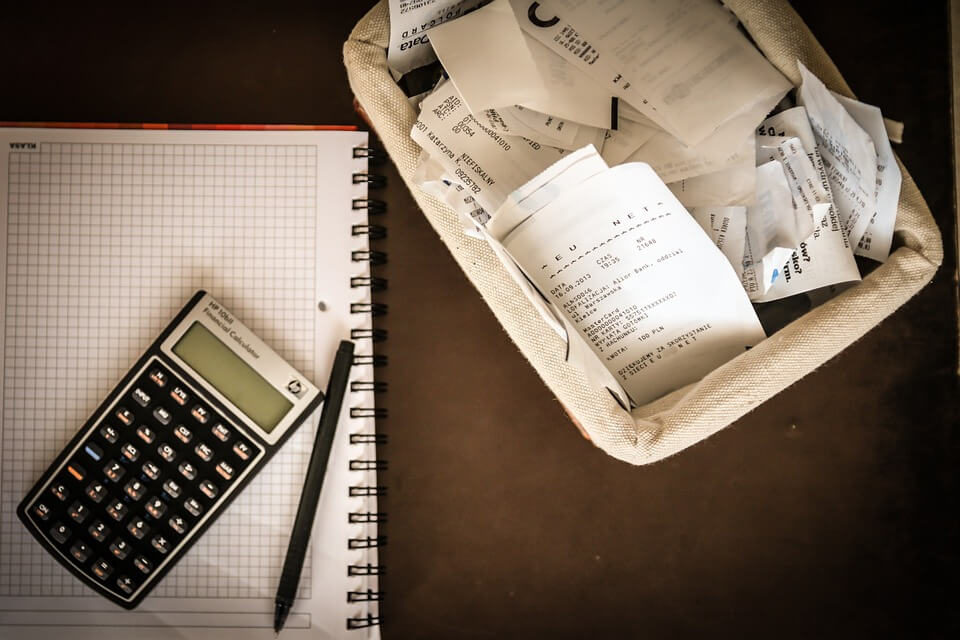

Preserve Your Receipts

What’s the best way to prove to the CRA that the deductions you’re claiming are genuine to a fault? You just have to keep the proof ready. When you save and store the receipts of the expenses that you’re incurring, you can safeguard your interests and claim your innocence in the event of a CRA audit. The question is: what happens if you can’t produce the necessary receipts in the event of a CRA audit? Your claim will be denied and you may be penalized for attempting to claim false deductions.

Missing Claimable Deductions

The mistakes you make while preparing your tax returns can also be harmful to your interests. For example, if you aren’t claiming the deductions you ought to be claiming, you’re paying additional tax dollars that are technically your profits. For instance, did you know that you can claim your traveling expenses that were meant for business reasons? Are you aware of all the expenses that can be claimed as deductions? If not, it may be a good idea to rope in an accountancy firm can guide you through.

Not Charging HST

This is most applicable to small businesses owners or start-up companies. Small businesses, when they are only just starting over, don’t have to charge HST. But, they are obligated to do so when they cross the $30,000 mark in profits. Once you cross that figure, it’s time that you apply for an HST number and start taxing on those lines. Most small business owners aren’t expecting a sizeable profit early on and they tend to miss the point at which they can, in fact, start to charge HST.

Forgetting About Capital Losses

This is a costly mistake as it can add up to thousands of tax dollars for some businesses. If your business has incurred losses this year, then you must not forget to report them. You can use these losses to wipe out the capital gains you’ve incurred this year. In the event that you’ve incurred no profits this year, it’s important that you’re aware that you can cancel out the capital gains you’ve suffered in the past three years or the capital gains that you will be incurring in the years to come. It can add up to serious money.

Do you believe you’ve made mistakes while filing your previous years’ tax returns? You can fix those mistakes under the Voluntary Disclosure Program. Those mistakes could hurt your interests in the event of a future CRA audit. Do you find the tax code complicated and frustrating? You’re certainly not alone. Many businesses prefer relying on an accounting firm to help them with their tax returns. They avoid making common mistakes such as these and they save hundreds and thousands of tax dollars in the process. Shall we get started, too?